There is a lot that goes into buying a home but knowing your credit score is likely one of the most important things.

FICO credit scores are used by most lenders to assess and extend credit alongside other details included on credit reports. Three credit bureaus report credit scores (TransUnion, Experian and Equifax ) and all are generally pulled whether you’re checking yourself or have authorized a lender to check. All three bureaus grade your credit history on a range from 350-850, but your score will differ from bureau to bureau because not all creditors report to all three companies. The middle score of the three is usually what lenders pay closest attention to.

What Credit Score Is Needed to Buy a House?

The minimum credit score you need to purchase a home will depend on the type of home mortgage you will qualify for.

The typical minimum credit scores by mortgage type are:

- Conventional Mortgage Loan: 620

- USDA RD Mortgage Loan: 620

- FHA Mortgage Loan: 580

- VA Mortgage Loan: 620

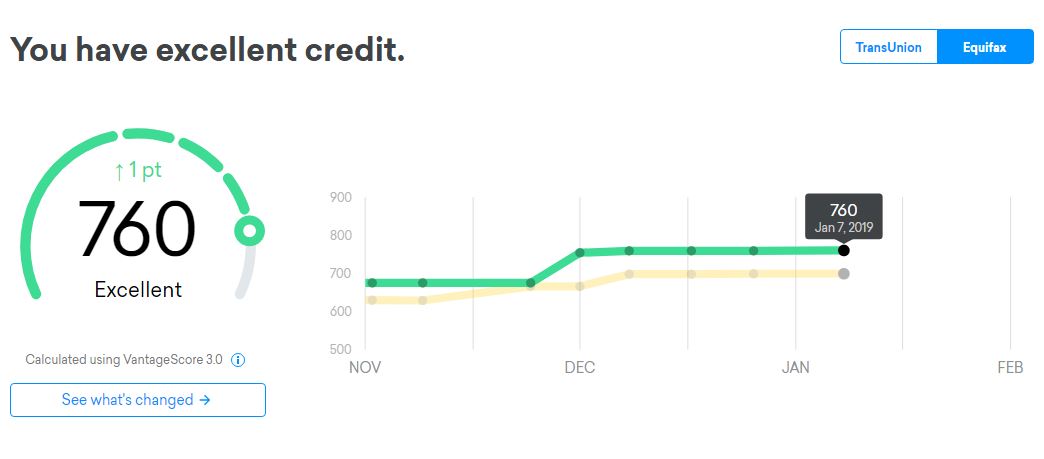

Check your Scores for Free

These three credible websites will give you all three credit reports and scores absolutely free. These companies even have an app that will alert you when something on your credit profile changes, so you can stay up to date with your credit score.

Wondering how your credit score stacks up?

- 350-579 = Bad credit score

- 580-619 = Poor credit score

- 620-679 = Fair credit score

- 680-739 = Average credit score, 740 and higher = Great credit score

Lenders look at more than just your credit score

When considering buying a home, credit score isn’t the only important factor. You will want to work with a trusted local and transparent lender who truly has your best interest in mind. Buying a home is one of the biggest investments you will ever make, and a good lender will ensure you’re making a good investment.

In addition to credit score, mortgage lenders will also look at your ability to repay the mortgage. They’ll review your present monthly debt vs. your gross income, recent payment history from your credit report and if there has been any derogatory credit. Employment history, money in checking and savings accounts, and other asset accounts will also be key factors lenders consider.

Lenders consider the 5 C’s of credit when reviewing and extending credit.

The Five C’s of Credit

Character: Measures responsibility, stability, credit history, honesty. Your interest rate and terms of the offer are impacted by character.

Capacity: Ability to repay the mortgage. Cash flow and your income vs debt ratio both impact capacity.

Capital: Amount of down payment you have available and where you are getting it. Your interest rate and mortgage terms are impacted by capital.

Credit: Your credit score is used to reflect your borrowing history.

Collateral: Additional security for the lender. Attributes of the property such as location, characteristics and resell ability ensure a lender can sell the property if you aren’t able to pay the mortgage.

Here at Honor Bank we provide expert advice, guidance, and education to help you through the process of purchasing a home. Your experience is our top priority and we value your relationship. Experience the difference at Honor Bank. Call today and schedule a consultation with one of our mortgage experts!

For More Information call 231-639-1800 or visit us online.